Some Known Details About Tulsa Bankruptcy Consultation

Some Known Details About Tulsa Bankruptcy Consultation

Blog Article

Fascination About Best Bankruptcy Attorney Tulsa

Table of ContentsThe Only Guide for Tulsa Ok Bankruptcy SpecialistSome Known Incorrect Statements About Chapter 7 - Bankruptcy Basics 4 Simple Techniques For Chapter 13 Bankruptcy Lawyer TulsaGetting The Tulsa Bankruptcy Attorney To Work9 Simple Techniques For Experienced Bankruptcy Lawyer Tulsa

The stats for the various other main type, Chapter 13, are also worse for pro se filers. (We damage down the differences between the 2 enters depth listed below.) Suffice it to state, speak to a lawyer or more near you who's experienced with insolvency regulation. Here are a couple of sources to locate them: It's reasonable that you could be hesitant to spend for a lawyer when you're already under considerable monetary stress.Many attorneys additionally supply cost-free consultations or email Q&A s. Take advantage of that. Ask them if insolvency is indeed the appropriate option for your scenario and whether they believe you'll certify.

Advertisement Currently that you've made a decision personal bankruptcy is indeed the best program of action and you hopefully cleared it with a lawyer you'll need to obtain begun on the documents. Before you dive into all the main insolvency forms, you ought to get your own documents in order.

All about Tulsa Bankruptcy Attorney

Later on down the line, you'll really require to confirm that by revealing all kind of details concerning your monetary affairs. Below's a standard checklist of what you'll need when traveling in advance: Determining papers like your vehicle driver's permit and Social Safety card Tax obligation returns (approximately the past four years) Proof of income (pay stubs, W-2s, independent earnings, earnings from assets as well as any earnings from government benefits) Bank statements and/or pension statements Evidence of worth of your assets, such as vehicle and property valuation.

You'll want to understand what sort of debt you're attempting to resolve. Financial obligations like kid support, spousal support and certain tax obligation financial obligations can't be released (and insolvency can not stop wage garnishment relevant to those debts). Student financing financial obligation, on the other hand, is not impossible to discharge, however note that it is hard to do so (Tulsa bankruptcy lawyer).

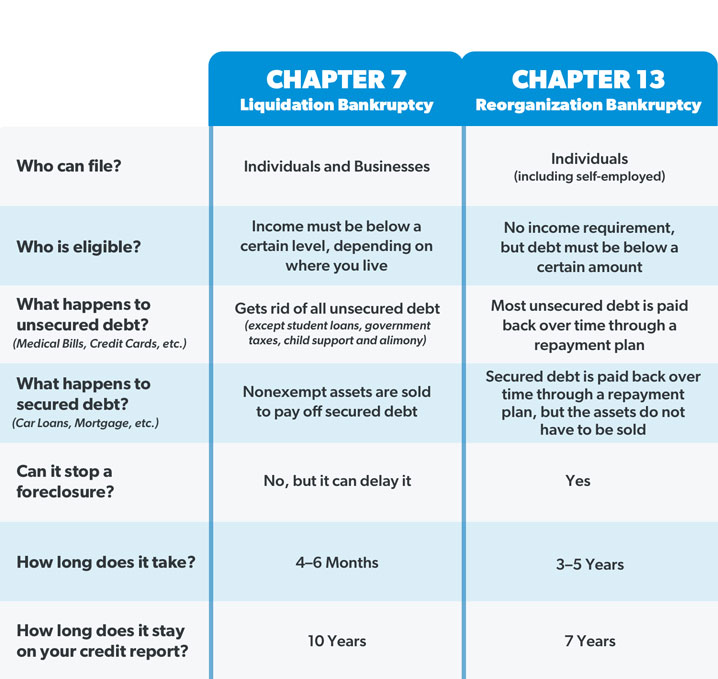

You'll want to understand what sort of debt you're attempting to resolve. Financial obligations like kid support, spousal support and certain tax obligation financial obligations can't be released (and insolvency can not stop wage garnishment relevant to those debts). Student financing financial obligation, on the other hand, is not impossible to discharge, however note that it is hard to do so (Tulsa bankruptcy lawyer).If your earnings is expensive, you have an additional alternative: Phase 13. This alternative takes longer to settle your financial obligations since it calls for a long-term payment strategy generally three to 5 years before a few of your continuing to be financial debts are wiped away. The declaring process is likewise a whole lot more intricate than Phase 7.

Tulsa Debt Relief Attorney Things To Know Before You Get This

A Chapter 7 bankruptcy remains on your debt record for ten years, whereas a Phase 13 insolvency diminishes after seven. Both have enduring effects on your credit rating, and any kind of new financial debt you secure will likely come with greater rates of interest. Before you submit your bankruptcy forms, you must initially finish a necessary course from a credit history counseling agency that has actually been accepted by the Department of Justice (with the significant exception of filers in Alabama or North Carolina).

The training course can be finished online, in person or over the phone. You should finish the course within 180 days of filing for personal bankruptcy.

Which Type Of Bankruptcy Should You File Can Be Fun For Anyone

An attorney will typically manage this for you. If you're submitting on your own, recognize that there are concerning 90 different bankruptcy districts. Check that you're filing with the appropriate one based on where you live. If your permanent house has actually moved within 180 days of loading, you must submit in the district where you lived the better section of that 180-day period.

Commonly, your bankruptcy attorney will function with the trustee, but you might require to send the person records such as pay stubs, tax obligation returns, and bank account and credit scores card declarations straight. A typical mistaken belief with bankruptcy is check out the post right here that when you file, you can stop paying your debts. While bankruptcy can help you wipe out several of your unprotected financial debts, such as past due clinical expenses or personal car loans, you'll desire to maintain paying your month-to-month settlements for protected debts if you want to maintain the residential property.

Excitement About Chapter 7 Vs Chapter 13 Bankruptcy

If you're at threat of foreclosure and have actually worn down all other financial-relief alternatives, after that declaring Phase 13 might postpone the repossession and help save your home. Ultimately, you will certainly still require the income to continue making future home loan repayments, Tulsa OK bankruptcy attorney along with settling any kind of late repayments throughout your settlement plan.

If so, you might be required to provide extra details. The audit can postpone any kind of financial obligation alleviation by several weeks. Of training course, if the audit shows up wrong info, your situation could be disregarded. All that claimed, these are relatively uncommon circumstances. That you made it this much in the process is a decent indicator a minimum of a few of your financial debts are eligible for discharge.

Report this page